Equitable global development requires that basic needs are met in communities safe from the worst effects of war, global warming, pollution, poverty, and pandemics. Problems persist because we lack a systematic response – but we can gain that if oil and military firms causing problems are transformed into platforms for civilian, sustainable development through conversion and proactive investment campaigns aimed at universities and local investment actors, writes Jonathan Michael Feldman, who works in the Department of Economic History and International Relations at Stockholm University.

In Yemen, a BBC report noted UN warnings that over 100,000 people have been displaced because of the fighting there, and that two million civilians are at risk. Last year, the conflict was projected to have caused over 377,000 deaths, with 60 percent of them the result of hunger, lack of healthcare and unsafe water.

The Ukraine war has led to the deaths of 4,500 persons, and about 6 million refugees. The World Health Organization (WHO) noted over 6 million deaths from Covid as of May. The World Bank says that between 75 million and 95 million additional people could be living in extreme poverty in 2022 compared to pre-Covid-19 projections, due to the lingering effects of the pandemic, the war in Ukraine, and rising inflation.

António Guterres, the UN Secretary General, said recently that unless dramatic action is soon taken about the climate crisis, some major cities will soon be under water and noted forecasts of “unprecedented heatwaves, terrifying storms, widespread water shortages and the extinction of a million species of plants and animals.”

Oil and military companies – two key actors

Two key actors both contributing to global warming and with resources to address global challenges are oil and military companies. Together they have the scale of resources necessary for systemic transformation.

Let us look at three of the largest oil and gas firms in the top ten by market capitalization – ExxonMobil (2nd), Shell (4th) and BP (10th). On the oil front, last year, ExxonMobil earned 23 billion US dollars. At the start of 2022, Shell’s adjusted earnings were 9.1 billion. During the start of 2022, BP’s profits more than doubled to 6.2 billion dollars. Despite losing money during the pandemic, oil companies have made record profits in the wake of rising oil prices.

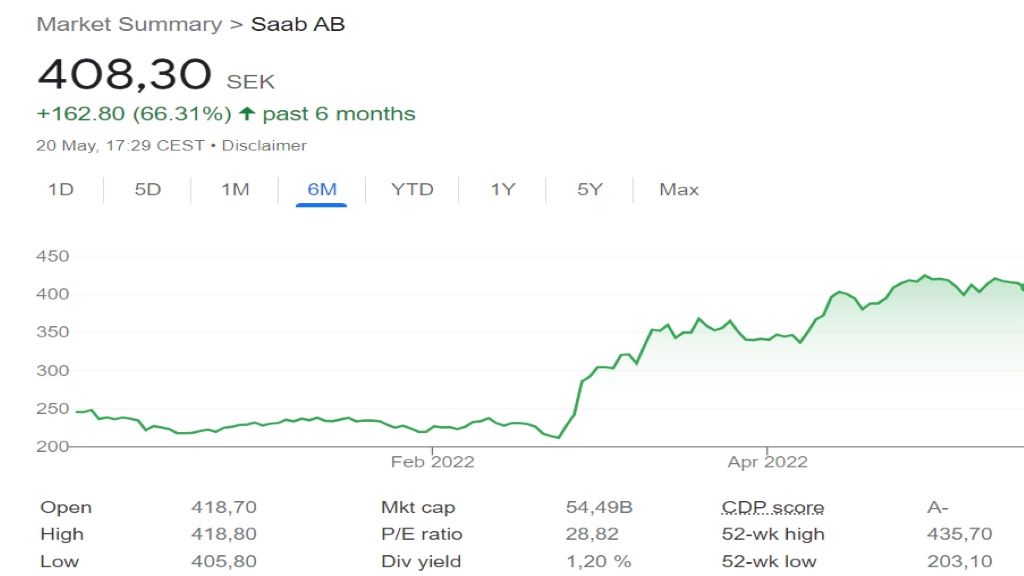

Let us now look at military firms and their patrons. After the war in Afghanistan began, the Pentagon spent over 14 trillion US dollars as part of overall military spending. Defense companies are expected to profit from the war in Ukraine, with defense stocks for many companies increasing. Sanctions on Russia and war-related disruptions have helped raise the price of oil. Increasing mobilizations by security experts, mass media, politicians and related military firm engagement have helped displace energies and resources to meet competing crises.

Conversion and dismantling

A counter-mobilization is needed to reverse ecological problems through conversion and dismantling, which can help transform the resources banked by oil and military firms into mechanisms to address the crises.

Conversion is a shift in what companies make and what markets they serve. Dismantling involves ending financial support if not elimination of a firm or product – like oil. The money spent on war represents a budgetary diversion for green investments. A Green (New) Deal, built on ecological investment and military and petroleum divestment could help transfer firms towards making mass transportation systems, systems to facilitate electrification of transport, alternative energy, decarbonization technologies and various climate adaptation infrastructure. The economic shift from the oil and war economy can facilitate a political shift encouraging sustainability and diplomacy. Conversion can expand the domestically anchored economy leading to less export of ecological problems. As less is imported from far away, more local jobs are created, with fewer transport emissions and greater potential allies in unions.

The conversion processes required for oil companies is discussed in the book Petroleum Industry Transformations: Lessons from Norway and Beyond. Many Norwegian oil and gas firms have diversified into the offshore wind power industry based on related technologies. Incentives for diversification include pressures for meeting ecological goals and the downturns in oil prices. Elsewhere Markus Steen and Gard Hopsdal Hansen argue that knowledge, financial investments, and public opinion can influence a green conversion of oil. The conversion of defense firms to civilian markets also requires knowledge, alternative markets, financing and administrative commitments.

The University and Local Investment Levers for Change

Europeans must choose between replacing Russian oil with other suppliers or building a local green energy system. How can we jump start an alternative green, civilian conversion process? The anti-apartheid movement understood that by divesting from local government, bank and university investments in apartheid South Africa, one could begin a public opinion change process that involved the necessary depth, speed, and scope.

Swedish activists Inga Thorsson and Greta Thunberg show how systemic change is possible. Inga Thorsson, a Social Democratic politician, showed that money from war could be transferred to needed civilian goals. Greta Thunberg shows how students and youth can help weaken the legitimacy of petroleum-based economies. A mobilization of universities could help initiate a shift in resources away from military and oil and towards civilian or ecological pursuits. There are thousands of universities in proximity to millions of students who could help leverage such a change process. Banks should also be pressured to disinvest in oil and defense firms. Networks of innovators in production networks can also address crises like Covid.